In today’s fast paced world, financial needs can arise at any moment. Whether it’s an unexpected medical bill, a home repair, or a dream vacation you’ve been planning, sometimes you need cash and you need it fast. The good news? Getting a personal loan instantly is no longer a far fetched idea. With the rise of digital lending platforms and streamlined processes, securing funds quickly has become easier than ever. In this blog post, we’ll walk you through everything you need to know about getting a personal loan instantly, so you can make informed decisions and meet your financial goals without delay.

Why Choose an Instant Personal Loan?

Instant personal loans have gained popularity for several reasons:

- Speed: Traditional loans can take days or even weeks to process. Instant personal loans, on the other hand, are designed to provide funds within hours or minutes of approval.

- Convenience: The entire process is online, meaning you can apply from the comfort of your home or on the go.

- Flexibility: Personal loans can be used for almost any purpose debt consolidation, emergencies, weddings, or even a shopping spree.

- No Collateral Required: Most instant personal loans are unsecured, meaning you don’t need to pledge assets like your home or car.

How to Get a Personal Loan Instantly

Here’s a step-by-step guide to help you navigate the process:

1. Check Your Eligibility

Before applying, ensure you meet the basic eligibility criteria, which typically include:

- Age (usually between 21 and 65 years)

- Minimum income requirements

- A good credit score (though some lenders offer loans for low credit scores too)

- Employment status (salaried or self-employed)

2. Compare Lenders

Not all lenders are created equal. Take the time to compare interest rates, processing fees, loan tenure, and customer reviews. Look for lenders that offer pre-approved loans, as these can significantly speed up the process.

3. Gather Required Documents

While instant loans require minimal documentation

4. Apply Online

Most lenders have user-friendly websites or mobile apps where you can fill out an application form. Make sure to provide accurate information to avoid delays.

5. Get Instant Approval

Thanks to advanced algorithms and AI, many lenders can approve your loan application within minutes. If approved, the funds are often disbursed directly to your bank account within a few hours.

Tips to Increase Your Chances of Approval

- Maintain a Good Credit Score: A higher credit score increases your chances of approval and can help you secure lower interest rates.

- Keep Your Documents Ready: Having all your documents in place can speed up the verification process.

- Avoid Multiple Applications: Applying to multiple lenders at once can negatively impact your credit score. Instead, compare lenders and choose the best one for your needs.

Things to Watch Out For

While instant personal loans are convenient, it’s important to be cautious:

- High-Interest Rates: Some lenders may charge higher interest rates for quick disbursal. Always read the fine print.

- Hidden Fees: Look out for processing fees, prepayment charges, or late payment penalties.

- Scams: Only borrow from reputable lenders or platforms. Avoid unsolicited loan offers that seem too good to be true.

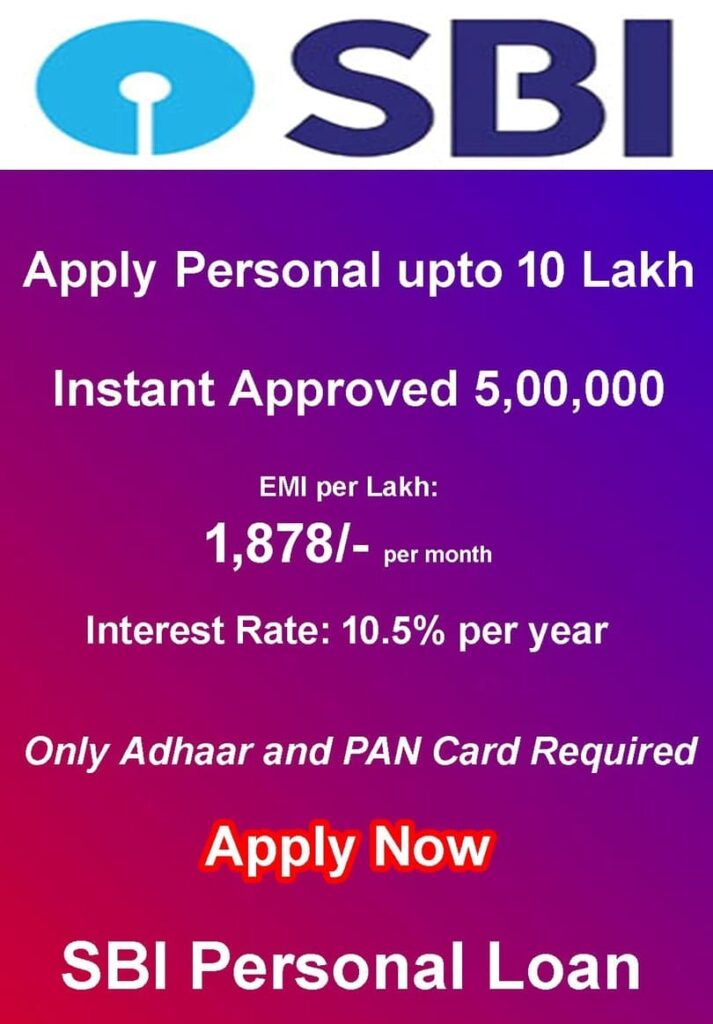

Top Lenders Offering Instant Personal Loans

Here are a few trusted lenders and platforms known for quick disbursal:

Click here to show Top Lenders List

Conclusion

Getting a personal loan instantly is no longer a luxury it’s a reality. With the right preparation and a bit of research, you can secure the funds you need without the stress and delays of traditional lending. Whether it’s for an emergency or a planned expense, instant personal loans offer a convenient and flexible solution to meet your financial needs.

So, the next time you’re in a pinch, remember: quick cash is just a few clicks away. Apply wisely, borrow responsibly, and take control of your finances today!